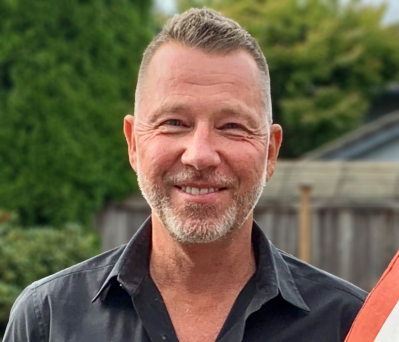

Embracing his higher purpose years into a multifaceted career in finance, Bob Bedritis helps fellow entrepreneurs maximize the value of their life’s work as Founder and Managing Director of Oswego Private Wealth Management

Born and raised in Ohio, Bob Bedritis’ decades of success in the financial industry – including lengthy management stints at Merrill Lynch and PaineWebber/UBS – have taken him everywhere from San Francisco and New York City to his current home base of Oregon. During his corporate days with UBS in the 90s, he estimates that he accumulated 3 million airline miles.

Yet the embrace of his destiny and higher purpose, helping fellow entrepreneurs maximize the value of their businesses as Founder and Managing Director of Oswego Private Wealth Management in Lake Oswego OR, has its roots in other travels – those related to the inspiring immigrant story of his Latvian-born parents, who met at a displacement camp run by the British and American soldiers in Munich after World War II.

Bedritis’ father – who had been wounded in the war fighting Soviet aggression – and mother had their papers ready to relocate to Australia when the First Baptist Church of Cleveland intervened and sponsored them and his mother’s parents to start a new life of freedom in the U.S. With his father’s formal education ending at age 16, he wasn’t qualified to do many things. He got a job with American Automatic Vending and went to school at night. His tireless work ethic and devotion to creating stability for his family led him to work for the company for 30 years, rising through the ranks to eventually become its GM, running their operations in all Central Ohio.

In more mythical tales of immigrants making good on the American Dream, the story might end on that high note. But one day, when Bedritis came home from Miami University of Ohio – his father told him AAV had been bought out and he was fired. At 52, he had to start over – and, true to his history of rising above adversity, the next chapter in his life proved even more fascinating. Drawing on the contacts he had made, he launched Buckeye Business Associates, serving as a broker who helped buyers and sellers of restaurants and bars. He ran it successfully for a decade before retiring. Meanwhile, Bedritis’ mother became a top selling Avon Lady for a whopping 61 years; when she retired the company honored her as one of the nation’s top representatives.

Though once out of college, Bedritis found himself on the whirlwind and treadmill of many successful years in corporate finance, the seeds of his future entrepreneurial endeavors had been planted. Decades later, in 2001, Bedritis experienced an anxious crossroads very similar to his father’s. When he was the Head of Wealth Management for UBS in New York, his desire to have more time with his wife and four children led him to accept an offer to be the CEO of Portland based M Securities, the fourth largest privately held company in Oregon.

Then, about a year into his time there, the company’s board decided Bedritis was not the CEO they wanted.

“My focus is on men and women who have taken a risk to build something of value.”

– Bob Bedritis

At 42, a decade younger than his father was when he found himself in similar circumstances, Bedritis began to reflect on what he truly wanted in life. “I realized that I never liked being a corporate guy,” he says. “I enjoyed the freedom of time, purpose, and relationships that are part of being an entrepreneur. Deciding my corporate days were through, I launched Paradigm Capital Group, consulting hedge funds and private equity firms. I finally had what I considered a purpose-driven business, setting my own schedule and working with people I could profoundly help, not just random clients.”

After 13 years as Founder and President of Paradigm, Bedritis grew disillusioned with consulting for corporate clients whose actions and ethics turned out to be much darker than he thought when he signed on. Thinking about what he wanted to achieve with his new company, he reflected on his father’s journey as an entrepreneur, his mother’s career as an Avon lady, and his own trajectory from the corporate world to a more entrepreneurial lifestyle. He became convinced who it was that he felt called to serve and launched Oswego Private Wealth Management with an essential goal – to help his fellow entrepreneurs and business owners.

Another motivating factor in Bedritis’ decision to create a firm dedicated to managing the wealth of business owners is that his parents, despite their many years of success, never received meaningful and enduring financial advice. His father lacked a succession plan, so when he retired, he had no other option but to close his business. Since launching Oswego Private Wealth Management in 2015, Bedritis has worked tirelessly to provide impactful and enduring plans to business owners to help them make smart decisions about their investments and succession plans.

“What gets me up in the morning, my reason for being, and what I’ve become known for is helping successful business owners become financially independent of their businesses,” he says. “I started out working with individual retirees and the business grew pretty quickly – but as I took on more business owners and entrepreneurs, I realized I wanted to focus on working with those folks who take a risk, make payroll, and are in essence responsible for building America. I tell them, ‘I believe you deserve to maximize the value of your life’s work.’ I often work with owners who struggle with the overwhelm of running their businesses so they can take care of their families.

“My specialty is those who find themselves within a few years of being at a point where they can sell their businesses,” Bedritis adds, “whether they’re passing it on to family members or others. I have focused Oswego Private Wealth Management and dedicated it to specialize in exit planning to help maximize the value of their life’s work. We often work with successful business owners who struggle with the complexities of maximizing the value of their life’s work so they can take care of the people they love, give generously to the causes they care about, and live an amazing life of significance. My focus is on men and women who have taken a risk to build something of value.”

One of the most powerful ways in which Bedritis helps his clients address the pain and challenges of maximizing their value and selling their businesses is by creating a Virtual Family Office. Over the years, he realized that most entrepreneurs lack and need a coordinated team of professionals with different expertise looking out for them.

Explaining that the concept of having a “family office” goes back to the days of the Carnegies and the Rockefellers, who needed money coordinators, real estate specialists, a legal team, accountants, and bankers looking out for their best interests, Bedritis sets himself up as the quarterback of each client’s exit planning. He assembles a team of outside experts to facilitate various aspects of the client’s dealings. The group includes a CPA, business attorney, estate planner, property and casualty people and investment banker. The investment banker assists with lending capabilities and walking the client through the sale on a tax efficient basis.

“It’s about more than simply connecting my client to these professionals,” says Bedritis, “It’s bringing them together to coordinate every detail of what they are doing individually. The business owners I work with generally have companies worth from five to $50 million. They don’t have the luxury or ability of building their own valued family office, so I do it for them. Why not have the benefit of the advice a virtual family office can provide?”

Another aspect of the firm that sets Bedritis and Oswego Private Wealth Management apart is their five-step process, which begins with a Discovery Meeting (the “get to know” session) and includes an Investment Plan Meeting, a Mutual Commitment Meeting, a 45-Day Follow-up Meeting and Regular Progress Meetings. Bedritis spends a lot of time in the Discovery Meeting learning about his prospective client’s values, goals, relationships, dreams, aspirations, and assets. He also finds out who the client’s current advisors are and how they have worked with the prospective client in the past, what their financial goals are, and about their outside passions and interests. Once the client signs on, Bedritis synthesizes all the information to create a preliminary plan within the framework of a virtual family office.

On a personal level, one of the most remarkable aspects of Bedritis’ relatively rapid success in building a thriving clientele is the fact that 15 months after launching – just as he was settling into the new business and securing his first clients – he took a racquet in the eye during a squash match. Active for many years as a tennis and squash player and all-around athlete, he suffered a detached retina and needed nine surgeries over the course of a single year.

Not long after that happened, Bedritis was diagnosed with prostate cancer, which also required surgery. At one point, his cancer caused a pulmonary embolism that nearly killed him. Over a 24-month period in 2017-18, between his eye, cancer, and embolism, he had 21 total surgeries. A committed Christian since his college days, his strong faith and relationship with God saw him through and gave him a wider perspective on the difficult but ultimately temporary trials he, his family, and his growing business faced.

“There were times I didn’t know if I would live or die, or what condition I would be in – or even if I would ultimately have a business to build here,” he says. “When I say that I deeply understand that what I do is about much more than money, I back it up with some hard life experience and a commitment to overcome all obstacles. It’s about taking care of people and helping ensure that they not only make smart decisions but also create an amazing life of significance. Technically I am a Financial Advisor, but what I really do is help business owners and their families defend their American Success Story in the midst of an uncertain world. With everything going on socially, economically, and politically, all the ongoing uncertainty, this immigrant’s son is happy to serve on behalf of and defend those who have worked hard to make a difference in this world.”